Opportunities for companies in the Packaging supply chain from the Premium growths of main end-users sectors

By ExportPlanning-Sistema Informativo Ulisse

In 2019, the growth of world trade in packaged consumer products continued…

The 2019 pre-estimates1, formulated by StudiaBo on the basis of the most recent economic data, indicate the continuation of the growth path of world trade in the main packaging’s end-user sectors.

In 2019, global demand for Packaged Food and Beverage2 showed estimated growth at constant prices of more than 5 percentage points, for a pre-consumption in euros of about 512 billion euros (573 billion dollars).

Similarly, at year end, global demand for Perfumes and Cosmetics3, thanks to an increase at constant prices of about 4 percentage points, is estimated to exceed 86 billion euros (96 billion dollars); global demand for Personal- and Home-Care4 products has risen by almost 3 percentage points at constant prices, with a pre-consumption estimated at around €156 billion (174 Bn $).

Last but not least, global demand for Drugs & Medicaments5 is experiencing an increase that by the end of 2019 should be close to 6 percentage points at constant prices, bringing the value of world trade to 546 billion euros (about 612 billion dollars).

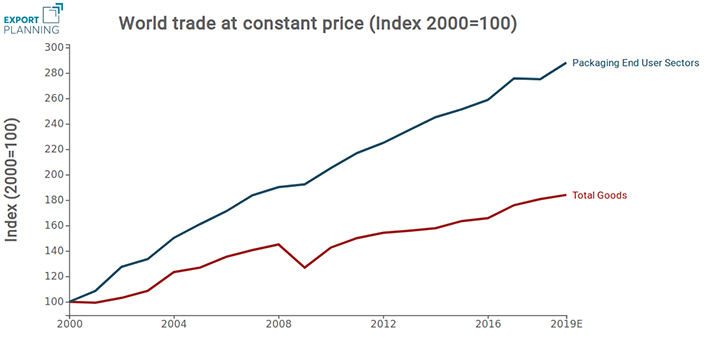

…confirming particularly favorable medium-period dynamics in the quantities…

The growth performance of global demand in the main end-user packaging sectors appears to be above average not only in the most recent period, but also in all the historical experience of the current century: in the average of the period 2001-2019, the Compound Annual Growth Rate (CAGR) measured at constant prices – thus excluding any inflationary or currency effects – is +3.8% in the Personal and Home Care sector, +4.4% in the Packaged Food and Beverage sector, +6.4% in the Perfumes and Cosmetics sector, and +8.2% in the Drugs & Medicaments sector, compared to a growth benchmark of +3.3% for total world trade in goods.

These growth rates confirm not only the “acyclical” nature of demand in these sectors in a context of a significant slowdown in the international cycle- as written in a previous article-, but also the presence of driving factors such as the growing importance of the Premium segments, as documented by the growth in quality purchases in all these sectors, some “fashion” effects (for example, the growth in Asia of the skin care phenomenon) and demographic factors (linked to the average ageing of the population) in many high-income countries.

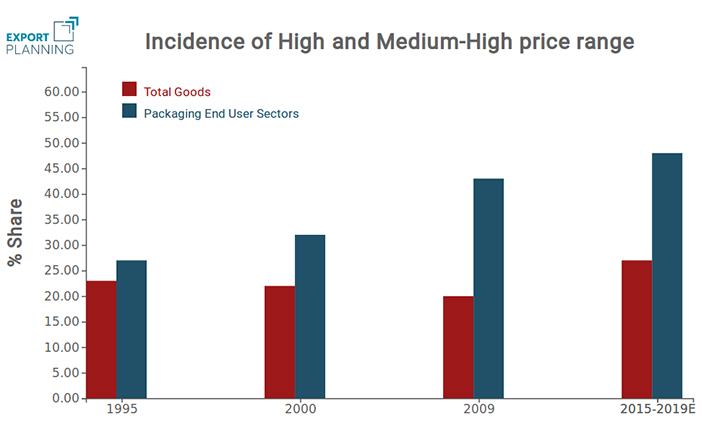

…and also the growing importance of the Premium segments

The growth performance at constant prices, which is more dynamic than the average, is also associated with an upgrading of demand in the main consumer packaged goods sectors.

Considering the incidence of the High and Mid-High price bands on total world trade by sector, the average for the period 2001-2019 shows particularly significant increases for Perfumes and Cosmetics (with the relevance of the “Premium” segments rising from 5.4% in 2000 to almost 54% in 2019) and Drugs & Medicaments (with the Premium segments this year representing more than 70% of the value traded worldwide).

The phenomenon is less accentuated in the Packaged Food and Beverage sector, where 28.4% of the value traded worldwide is attributable to the Premium segments; this is, however, a higher incidence than that shown by the total goods (25.9%). Moreover, it should be noted that in the last decade (essentially, from the beginning of the Great Recession to the present) in the Packaged Food and Beverage sector, the upgrading process has intensified, with only the High Price Range doubling its relative importance (from 6 to 12 per cent) and the Medium-High Price Range consolidating its share (above 16 per cent).

Growth opportunities in the 2020-2023 scenario

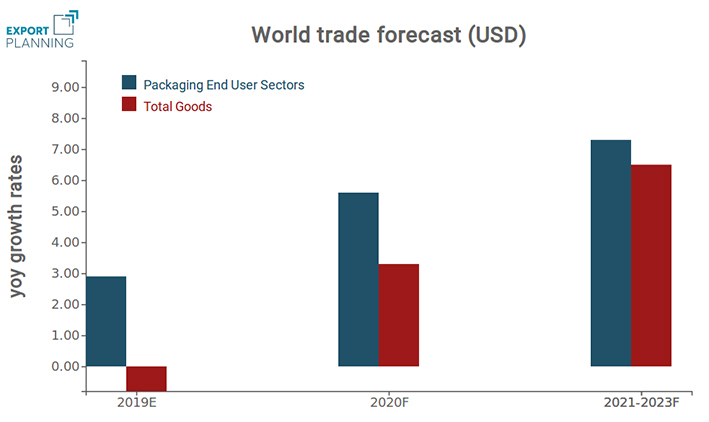

The forecasts recently formulated by StudiaBo6, starting from the latest World Economic Outlook of the International Monetary Fund, show for the 2020-2023 period particularly accelerated trends for world trade in packaged consumer products.

In the 2020-2023 scenario, it is expected that on average more accelerated dynamics will continue for the sectors that are most users of packaging: in particular, a CAGR of +8.2 in $ (+7.6% in euro) forecast for the Drugs & Medicaments sector, a CAGR of +6.5 in $ (+5.9% in euro) for the Perfumes and Cosmetics sector, +5.9% in $ (+5.3% in euro) for Packaged Food and Beverage, against a forecast of growth in $ values of +5.7% (+5.1% in euro) for total goods. In particular, next year – against a weakly positive trend for international trade in goods (+3.3% in $, +3.2% in euro terms), growth rates are expected to be more than double the average in the Pharmaceuticals sector (+7.1% in $), and more dynamic than the average – albeit to a lesser extent – in the Perfumes and Cosmetics (+5.2% in $), Packaged Food and Beverage (+4.5% $) and Personal and Home Care (+4.4% $).

Conclusions

These projections confirm a scenario of opportunities for companies in the Packaging supply chain, even though in a context of greater uncertainty linked to possible changes in both consumer habits and regulatory frameworks in favour of more environmental friendly packaging solutions.

In particular, it should be noted that forecasts for technology suppliers appear relatively less favourable, as they are more penalised by the effects of the current climate of uncertainty experienced at international level, which is particularly affecting the instrumental mechanics sectors (see for reference the recent article entitled “Effects of the Great Uncertainty at an International Level: Machinery is the most Affected Industry in terms of World Trade“).

1) For more information, please refer to the Ulisse Datamart in the Analytics section of ExportPlanning.

2) See the products’ list analyzed in the following industry’s description.

3) See the products’ list in the following industry’s description.

4) See the products’ list in the following industry’s description.

5) See the products’ list in the following industry’s description.

6) For more information, please refer to the Forecast Datamart in the Analytics section of ExportPlanning.